|

Taxes - What Can We Learn From History

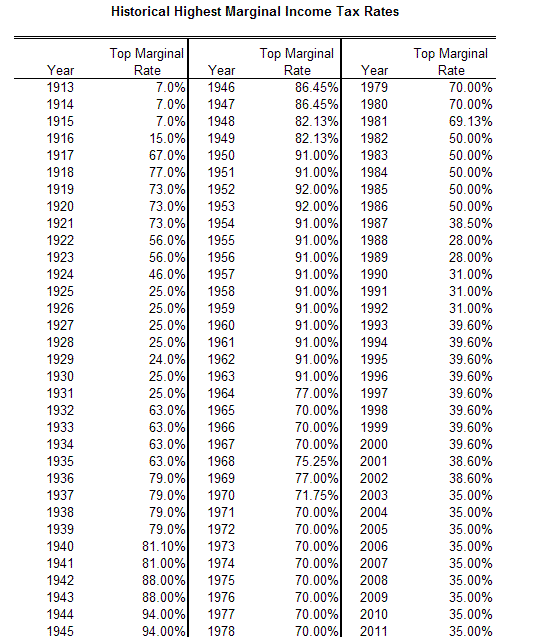

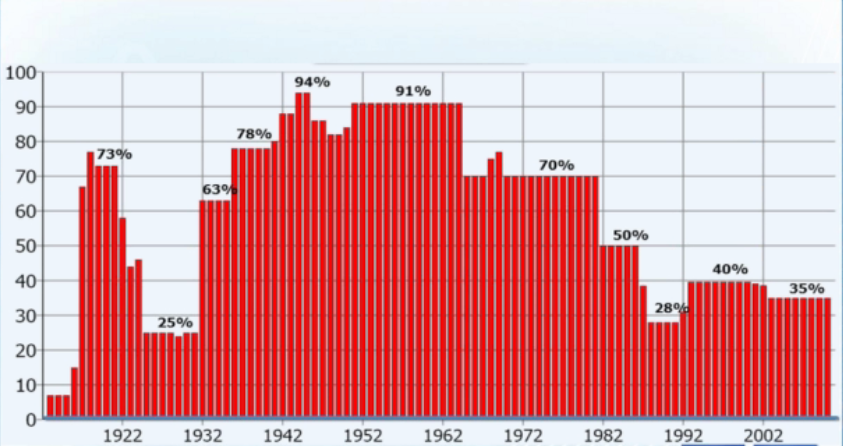

Tax Rates Have Fluctuated Greatly Over Our Lifetime

|

||

|

From 1917 until the present, the maximum tax rate has flucuated wildly from a low of 7% to a high of 94%. We have been enjoying a "low maximum tax rate" of 35% for the past 9 years while we have been building our deficit without restraint. Because of our deficit problems, it is likely that taxes are destined to go up, possibly dramatically. The question is: How is that going to affect me and what do I do about it? Everyone's situation is different. Some have IRAs, 401(k)s etc and some don't. etc.

**The best way to handle this situation for the long-term is to pay the taxes now on tax deferred assets such as IRAs and 401(k)s and convert them into their Roth equivalents. That will allow the inevitable tax burden to be minimized for yourself and your heirs and create a tax-free environment for future earnings. This, of course depends upon your ability to pay the taxes. It is the old concept of: "Do you want to pay taxes on the seed or the harvest?" In this case you get a double benefit

|

|

In the long run, you and your heirs will be much better off and have more after tax money in your pocket.

** Everyone's situation is different. This is 1 suggestion.

We have lots of information that has been beneficial to lots of people. Would you like to be added to our list?

Click To Add Me To Your Mailing List

Our Retirement Planning Website: www.statewideretirementplanning.com

To receive a free Income-For-Life Illustration, Contact us for a free appointment to work on your own customized financial plan.

If you are looking for a secure income stream while preserving your money, Call us at (954)781-2220, or email us to receive a free strategy session and income-for-life illustration. We can start you on your path to financial security today! There is absolutely no obligation.

Visit our Website at www.statewideretirementplanning.com

Dedicated To “Getting You To Retirement and Keeping You There”

|

Statewide Retirement Planning Co. |