|

You may still be working or saving for retirement in a qualified plan but are concerned about market fluctuations, changes in your account value and outliving your retirement funds. 401(k) plans impose restrictions on in-service withdrawals. Please check with your plan sponsor for details. (Usually the Human Resources Department)

Martin Gross PS Review our 10-minute video “Paycheck For Life”

|

401k Replacement Plan

|

Listen To |

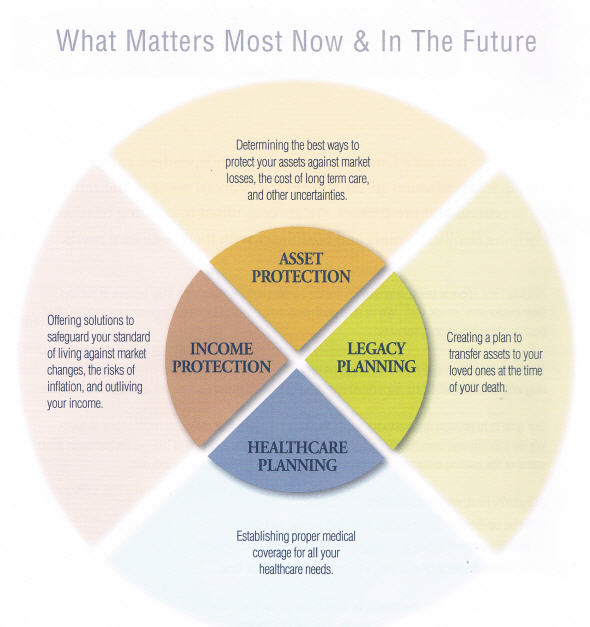

Prepare for the unpredictableThere is very little certain in life. Personal circumstances seem to change as often as the weather. And, the financial markets dance to a new beat every day.

|

||

|

Dedicated to making sure you do not outlive your Money!

Annuities are insurance products not FDIC insured and rates and guarantees vary by carrier. See product specific details for which plan is right for you. An insurance representative may contact you for further assitance. * Annuity guarantees rely on the financial strength and claims paying ability of the issuig insurer. |

|||

|

** New ** 8 hour Workshop: Conservative Investing Techniques In Our Current Environment. Cl'ck here for details. Website: www.StatewideRetirementPlanning.com Statewide Retirement Planning Co. |

|||