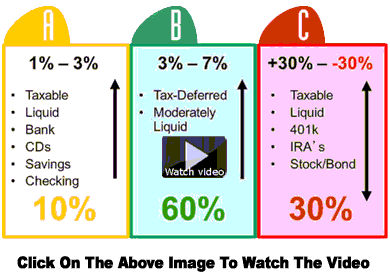

| Do you need a degree in finance to understand it? Is there a simple way to understand how to allocate your assets to accomplish your goals? There is a new model of investing being used by thousands of people to answer all the questions above. It’s the ABC Model of Investing and here’s how it works.

The ABC Model of Investing

First, imagine that all your investible assets are liquid (with no strings attached) and we could arrange them in any way you like. This includes all your CD’s, money markets, annuities, stocks, bonds, mutual funds, REITs etc. Next, let’s say that you could throw all the money on the table and place it wherever you would want it to go. Of course, I realize not all of your assets are actually liquid and in a position to move, but this exercise will give you a glimpse of what you value in the types of assets in which you might invest and how to allocate them. Finally, let’s divide assets into categories, A, B, and C, which represent three types of assets.

Category A: Cash “Yellow Money”

Category A is your cash reserves. Cash assets potentially carry low returns, but the principal is guaranteed and interest is compounded. These accounts are typically taxable and have optimum liquidity. However, they can also be set up in various tax-advantaged strategies such as traditional IRA’s, Roth IRA’s, etc. Most often, these are bank-held assets like CD’s, savings accounts, and money markets.

Financial advisors will often refer to this as short-term money, or emergency funds. If your furnace breaks down, your roof leaks, or you have a medical emergency, category A is where you save for such an occurrence. If you are saving for an exciting vacation or a new car, this is where the money goes. It is also where you might want to keep a savings account to replace any income lost due to a prolonged illness, injury, or job loss. You will want to have six months to a year of income put away for these instances.

Category B: Fixed Principal Assets “Green Money”

Category B holds Protected Growth assets. This category offers potentially moderate returns, is tax-deferred and offers partial withdrawals. The principal is protected, and previous years’ gains are retained as interest. The annual returns on these assets vary greatly. In my own practice, I have seen them yield from 0% to as high as 16%. Some include bonuses from 2% to 8%. These assets are designed to be the middle ground between CD’s and the market. During the five-year period from October of 2004 through September of 2008, Index Annuities averaged 5.42%, while CD’s averaged 2.78%.

I prefer using Fixed Indexed Annuities in Category B, which links the interest credits to the performance of a market index, such as the S&P 500, S&P MidCap 400, DOW, Russell 2000, Euro Dow, etc. Category B money is set-aside for a longer period, often 5-10 years. Annuities have strings attached for withdrawals, but can be an excellent source of income over a lifetime. In other words, don’t allocate money to the B Category in which you would need more than 10% of next year, especially considering it has a 10% tax penalty for withdrawals of interest prior to age 59 ½.

Generally assets in this Category offer only partial withdrawals without a penalty, yet many include riders that waive surrender fees in the event of a nursing home stay or terminal illness. Indexed annuities are designed to function as the middle ground between lower interest rates of bank and savings accounts, and potential higher returns of risk oriented market money.

The ABC Model looks at fixed income assets different than Wall Street does. Over the years, Wall Street has used a laddered portfolio of bonds to accomplish the goals of Category B, yet a bond can lose value. From 1999 to 2009, if you were holding Lehman Brothers, Bear Stearns, ENRON, or World Com bonds, you might have thought you were safe, but found out just how much you could lose in a bond. That is why we use fixed principal assets in this category rather than bonds, which are fixed income assets.

In contrast to bonds, Category B has three Green Money Rules: protect your principal, retain your gains, and guarantee your income. If an asset can’t do those three things, it doesn’t belong in the ABC Model’s Category B. Bonds don’t follow those rules so they must go in the next Category.

Category C: Risk “Red Money”

Category C represents the Growth column. We call investments here our “Red” Risk Growth assets, which move up or down with the market. Investors usually chase higher returns over time, though these assets can gain or lose 30% in a year, or even more. The S&P 500 lost 38% in 2008, but the average of 1995-1999 was over 25%. The market “giveth” and the market “taketh” away, there are no protections or limits. This money is invested in securities like stocks, bonds, mutual funds, variable annuities, options, REITs, and the like. The principal isn’t protected and last year’s gain may be lost in a downturn of the market. While these accounts are associated with a longer time horizon they are usually more liquid due to the “sellable” nature of securities, unless they are in a variable annuity, which only offers partial withdrawals.

The majority of the assets found in Category C are in retirement accounts such as 401(k)’s, 403(b)’s, IRA’s, and variable annuities. Category C monies can also be found in the form of non-qualified (after-tax) brokerage accounts, mutual funds, stocks, or bonds, held by an individual, jointly, or even in trust. You can be your own manager or hire a professional investment adviser to manage this part for you. This is the growth column, yet because of its high-risk nature, we paint these investments Red.

Here’s an example of the ABC Model. If you had $500,000 of investable assets and wanted a 10% “Yellow”, 50% “Green” and 40% “Red” money split, you would have about $50,000 liquid in bank accounts (Category A), $250,000 in fixed principal assets such as fixed indexed annuities (Category B), and about $150,000 in securities such as stock mutual funds, bond mutual funds, or managed accounts (Category C). With this allocation you only have 40% exposed to market risk. Needless to say, if the market experienced another 38% drop like in 2008, only 40% of your portfolio would be exposed to a loss. Sixty-percent would not have lost one red penny!

My suggestion is that you contact Statewide Retirement Planning Co. who uses both the ABC Model of Investing and the ABC Four Step Planning Process to help you determine the risk already in your portfolio and the risk you want in your portfolio. Remember Buffett’s Rule No. 1 and you’ll understand the power of the ABC Model of Investing.

If you want more information, you can go to www.abcconservativeinvesting.com or attend one of our classes at Broward Community School. Contact us for class registration. information. |