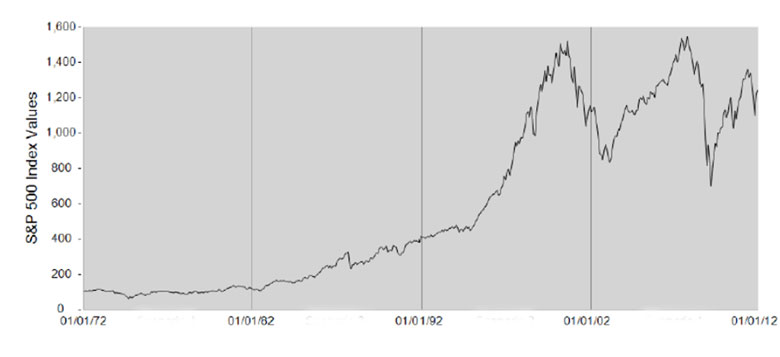

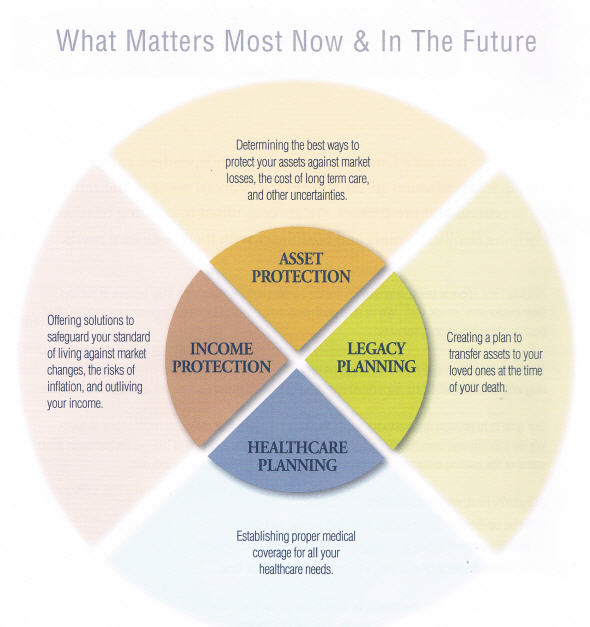

Our philosophy at Statewide Retirement Planning Co. is to work with our clients through education and information. We feel strongly that this approach will enable our clients to make better and more informed decisions. With this in mind, we have decided to send out a regular newsletter filled with information regarding all aspects of retirement and the retirement planning process. We hope that you enjoy reading these newsletters and are able to use the information to make your retirement years more secure and enjoyable than it otherwise might be. An Alternative To The Fear And Greed On Wall Street Until investors explore alternatives to Wall Street-based products, the fear gauge will continue to fall into the red and their financial woes will not be behind them. A recent article on CNN Money titled “Fear and Greed Index” illustrates an accurate description of what is happening on Wall Street. Make no mistake about it, the reason the fear gauge is so high is because in the market, investors have no guarantees in place in order to achieve their long-term goals. With non-leveraged assets (assets with a minimum leverage ratio of 1:1) you can get a moderate return without subjecting your money to volatility through a unique concept known as annual reset. Annual reset is a regulated concept (financial products protected by law) that will ensure you will never take a step backwards due to excessive volatility. There are millions of investors who have taken advantage of annual reset in order to protect their money from volatility. Those who implemented this philosophy prior to 2008 never lost a penny in the financial crisis when Lehman Brothers fell (at that time Lehman Brothers was leveraging their assets on a ratio of 33:1), and have experienced moderate returns since that point in time. These investors understand that regardless of how the market performs, they have underlying guarantees that offer lifetime income or tax advantaged withdrawals (for those who qualify) that will avoid volatility and allow for moderate returns. Never heard of these financial products? There is likely a good reason why. Financial planners often fail to make recommendations to products that use annual reset (offering financial guarantees) because they deem it a conflict of interest. Financial planners are in the business of hedging against risk, not providing total protection from risk. These philosophies differ by the way the planning phase (usually based on how institutions leverage their assets) is approached in both long-term and short-term goals. Annual reset is tied to products that do not offer securities, which is often interpreted as a lack of control by financial planners. Furthermore, there are many planners that do not buy into eliminating the downside of the market in exchange for financial guarantees that come with capped earnings. They feel their market driven products can yield a favorable return over a period of 30 plus years, as the market has done historically. (Prior to 2000)

Until investors explore alternatives to Wall Street-based products, the fear gauge will continue to fall into the red and their financial woes will not be behind them. The question to ask yourself is how much time and money are you willing to lose before the market corrects itself? Contact us Here to arrange for your complementary consultation and get rid of the fear and into your reliable guaranteed for the rest of your life income program tailored to your situation, allowing you to sleep at night and not worry about losing any more money in the stock market. This is a must for your “Have To Money”. Money that you must count on to pay for your everyday bills. Get your “Fear and Greed” Index into the green, where it belongs, and out of the red zone. Martin Gross Dedicated to making sure you do not outlive your Money! Call us now at (954) 781-2220 or fill out this short survey to find out more about how you might receive guaranteed* income for life and protect your principal at the same time!

* Annuity guarantees rely on the financial strength and claims-paying ability of the issuing insurer. |

||

**8 hour Workshop: New Conservative Investing Techniques In A Bear Market. Cl'ck here for details. ** Cli'ck Here to Get Your FREE gift that will help you plan for long-term care expenses. and your income for life illustration. Go To SMARTMONEY Newsletter Archives Website: www.StatewideRetirementPlanning.com

Review our Highly Acclaimed Videos: Review our 10-minute video “Paycheck For Life” Statewide Retirement Planning Co. |