Our philosophy at Statewide Retirement Planning Co. is to work with our clients through education and information. We feel strongly that this approach will enable our clients to make better and more informed decisions. With this in mind, we have decided to send out a regular newsletter filled with information regarding all aspects of retirement and the retirement planning process. We hope that you enjoy reading these newsletters and are able to use the information to make your retirement years more secure and enjoyable than it otherwise might be.

Please feel free to forward copies to your family and friends.

“Retirement Planning Is Not Only A Financial Decision”

Cash flow is only our means to get to the lifestyle goals that we want when retired

By Martin Gross

Statewide Retirement Planning Co.

Isn’t the above statement what retirement is all about? The real issue is spendable cash. Like the man said, “Cash is King.” During our entire working life we all think about how much money do we need to accumulate in order to “Retire”? The emphasis is on ROI (Return on investment). That is how Wall Street and the financial media trained us. I.e. what should I invest in to accumulate as much money as I can? Stocks, Bonds, Mutual Funds, Reits, … the list goes on. In my opinion, that approach worked just fine when the economy was great, the stock market was roaring (in the 80s and 90s), real estate could be counted on to grow etc.

The problem is that the environment changed and that approach no longer works. Yes, we have to still have to accumulate money for our future retirement. But the real question is when we get there, then what? What do we do with the money we accumulated? They didn’t tell us that. Some advisors talk about the 4% rule. That worked great in the old environment. Many people practiced that and are suffering dire consequences today because their investments didn’t accumulate enough money to support it, their investments plummeted, and their nest eggs dwindled. Their returns just didn’t keep up. Some years they went up. Other years they went down, and others stayed flat. They had to go back to work and/or get help from their families.

We have not been and are not prepared to deal with today’s environment of historically low interest rates and record levels of stock market volatility. These low interest rates, according to the Feds, will last at least into 2015, with no guarantee that they will start to rise even then. Even if they do, how fast will they rise and to what level? In addition to that, we are experiencing unprecedented volatility in the stock market and portfolios are going up and down like yo-yos. Most people, capture only a small fraction of market gains and most of the losses. If you look at the average return by individuals over many years vs. the historical average of the market, their average returns are only about 50% of the market returns. People are human and make investment decisions on emotion, not always the facts. In fact, the average person seldom gets all of the facts.

People are fleeing to bonds because they have “guaranteed interest rates”. The reality is that that too is risky. Those interest rates are only guaranteed if the company or municipality stays in business, decides not to call the bond in favor of a lower interest rate, or you hold the bond to maturity. We all know that when interest rates go up, the principal value of the bonds will tumble. Many financial experts expect that bonds will be the next bubble to burst. I have read numbers like you can expect a 5% to 8% decline in the principal value for every 1% increase in the interest rate depending on the bond.

Then there are those who are putting their money in safe bank vehicles like CDs, money market accounts etc. The problem is that they not only pay tax on any interest that they receive that year, but they are receiving returns much lower than inflation, which is approximately 3.0% to 3.5%.

Here are the current interest rates available from safe money vehicles

-

0.58% on savings accounts

-

0.45% interest in checking accounts

-

0.33% in certificates of deposit

-

EE savings bonds are earning 0.60%.

So their buying power is steadily eroding. This is a great conservative way to lose your buying power and dissipate your savings. Yes, There is such a thing as being too conservative.

With medical advances, how long will we live? Do we know how long to prepare for? The answer is no. We talk about life expectancy. That is a great term for the insurance companies for their planning. All that means is that 50% will die sooner, and 50% will live longer. What are the chances that you will die exactly at your life expectancy? When will your time be up? How do you know how long to plan for?

What, then, do retirees do? In my opinion, there is only 1 thing to do. That is put at least a portion of your money in places where the principal is protected, there is an opportunity for gains, and you have an income that is guaranteed to be there for the rest of your life, no matter how long you live, regardless of the market, interest rates, Europe, China, the price of oil, or even if your underlying account goes down to zero due to your withdrawals.

Why not insure your income to guarantee that you will have enough money to cover your day-to-day lifestyle needs (Your have to have money). We insure our health, life, auto, home, income if disabled (loss of income) etc. Why not insure our loss of income due to retirement also. Why does our loss of income have to be due to a disability? We also lose our income when we are not longer working, whether voluntary or not. Let’s insure our money so that we will be sure that we get to the lifestyle goals that we want when retired and never have to give them up because we ran out of money.

Contact us so that we can insure your retirement with your own personal pension guaranteed never to stop paying you your income for as long as you live.

Call us now at (954) 781-2220 or fill out this short survey to find out more about how you might receive guaranteed* income for life and protect your principal at the same time!

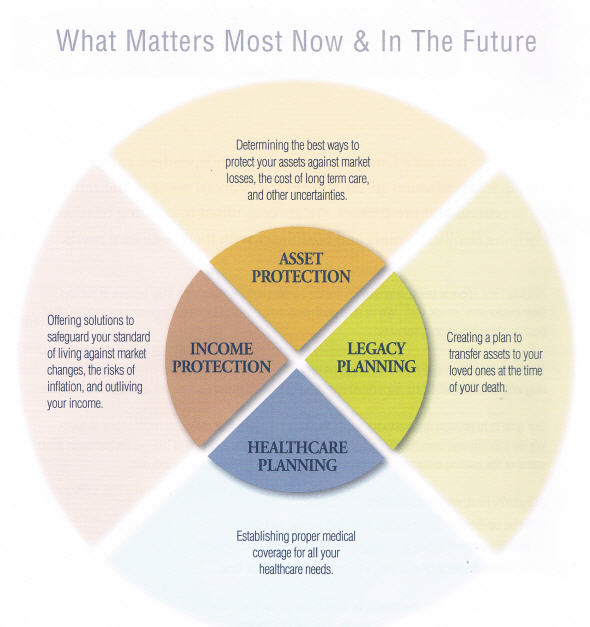

ASSET PROTECTION

INCOME PROTECTION

LEGACY PLANNING

HEALTHCARE PLANNING

Cl'ck here to receive information on a new workshop program, being taught nationwide, with fantastic success in educating folks on the Hows and Whys (the ABC’s) of conservative investing, saving, and planning your retirement nest egg to provide you with the retirement lifestyle you planned on. If done correctly, you will not be concerned with any outside influences such as the stock market, the price of gold, the price of oil, Iran, etc. etc. You will be able to sleep very well at night and not worry about having to go back to work. Your principal will be protected and you will NEVER lose any of your principal due to market variations EVER. You will be able to reap SOME OF THE MARKET GAINS WITH NONE OF THE MARKET LOSSES without having to make any buying or selling decisions. It will be automatic and run on autopilot. You will have your own “Personal Pension Plan.” This 6-9 hour workshop is finally coming to Broward County. Cli’ck Here for more details.

I also invite you to Cli’ck here to begin the process of scheduling a FREE strategy session with one of our licensed agents who specialize in retirement planning. You will also receive a custom income-for-life illustration.

This educational article is not designed to be a recommendation to buy any specific financial product or service.Check with your financial advisor or Statewide Retirement Planning Co. before making any decisions.

**8 hour Retirement Planning Workshop: New Conservative Retirement Planning Techniques In A Bear Market. Cl'ck here for details. **

Cli'ck Here to Get Your FREE gift that will help you plan for long-term care expenses. and your income for life illustration.

Go To SMARTMONEY Newsletter Archives

Website: www.StatewideRetirementPlanning.com

Review our Highly Acclaimed Videos:

Review 13-minute video “Retirement Made Easy”

Review our 10-minute video “Paycheck For Life”

Review our short 2-minute video on THE SMART, NO-COST way to "Protect Your Wealth From Poor Health"

Contact us to receive your free customized, guaranteed Income-For-Life Illustration. Call us at (954) 781-2220 or email us at swinspro@gmail.com. We can start you on your path to financial security today! There is absolutely no obligation.

Statewide Retirement Planning Co.

(954) 781-2220

www.statewideretirementplanning.com

smartmoneypro@gmail.com

PS- We would appreciate any feedback or comments that that you may have.

The purpose of this newsletter is to provide information and education about industry trends to our clients, potential clients and other professionals. Information about product offerings, services, or benefits is illustrative and general in nature. While every attempt is made to ensure the accuracy of the information provided, we do not guarantee the accuracy of the information.

This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. Please consult with a professional specializing in these areas regarding the applicability of this information to your situation.

No Spam Guarantee: We will not sell or rent your name or contact information to any 3rd party.

No Spam Guarantee: We will not sell or rent your name or contact information to any 3rd party.

If you no longer wish to receive this newsletter or want to change your email address, simply follow this link: Unsubscribe |