What Is The Market Going To Do Next?Why would someone who wants to have their funds protected and still grow, choose anything but an indexed annuity?

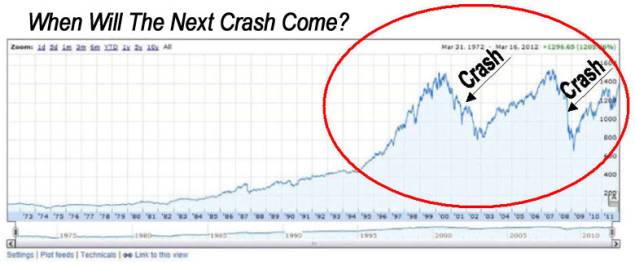

S&P 500 from 3/31/1972 – 3/16/2012

When will the next bubble pop and send the market reeling like the tech bubble and housing bubbles did in 2000 and 2008? 401K’s flooded the stock market with buyers. Now seniors, the fastest growing demographic in our country, are doing just the opposite. They are fleeing to safety and withdrawing their money from the market that they need for income. This could make it very difficult for the stock market to find buyers in the future to duel growth compared to what we have seen in the past. Add to that:

No one knows for certain what the market will do, but we do know what affects it i.e. risk factors. Unfortunately, the risk business is booming. I was in a meeting this week with an older client of mine who said her broker told her not to worry about the market, it always comes back… Here is my question: Call us now at 1-877-805-0151 or fill out this short survey to find out more about how you might receive guaranteed* income for life and protect your principal at the same time! *Annuity product guarantees rely on the financial strength and claims-paying ability of the issuing insurer. |

**8 hour Workshop: New Conservative Investing Techniques In A Bear Market. Cl'ck here for details. ** Cli'ck Here to Get Your FREE gift that will help you plan for long-term care expenses. and your income for life illustration. Go To SMARTMONEY Newsletter Archives Website: www.StatewideRetirementPlanning.com

Review our Highly Acclaimed Videos: Review our 10-minute video “Paycheck For Life” Statewide Retirement Planning Co. |